Bhavish Aggarwal-led Ola Electric claims to be in consolidation mode — the company’s Q1 FY26 results show a slight increase in revenue on a sequential basis, but Ola Electric is still some way away from its FY25 position after the June quarter.

But Aggarwal told analysts and shareholders that this is a period for the company to extract profits from its full stack approach. Ola Electric claims it is going from a hypergrowth EV disruptor to a maturing company focused on capital efficiency, vertical integration, and long-term sustainability.

Incidentally, the broader Indian electric vehicle market is also no longer in its euphoric phase. So is this Ola Electric simply acknowledging that the boom is over and now is the time for the real test and investment in the long term?

EV Market Slows DownMost indications are that the initial momentum for EV adoption has slowed, especially as government incentives have been phased out. Consumer sentiment is entering a phase of cautious optimism rather than enthusiasm.

Just a day before Ola Electric’s results, close competitor Ather Energy stressed that it’s time for the industry to move beyond sales and focus on innovation. Ola Electric is now singing the same tune. Is this just Ola and Ather managing investor expectations at this point in time?

Either way, in this environment, Ola’s decision to shift gears seems logical.

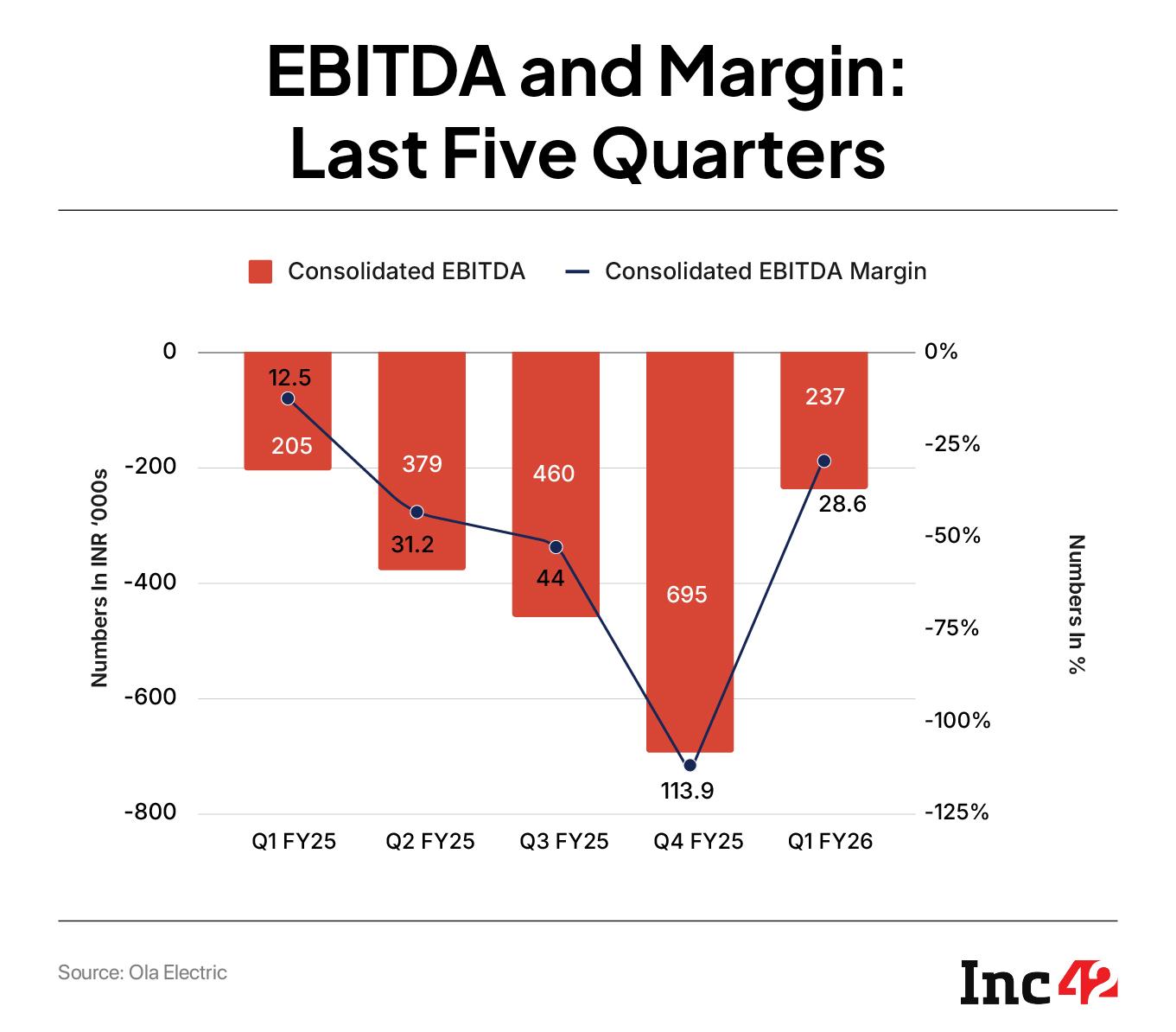

There’s some merit to this as far as the fundamentals are concerned. Ola Electric’s auto segment was EBITDA positive in the month of June, a first for the company. It’s not clear what exactly changed in June for this to happen.

Operational cash flow was near breakeven for the quarter, and the company expects to be free cash flow positive in its auto business by the end of FY26.

According to Aggarwal, no large manufacturing capex in the auto segment is expected in the year and investments are now weighted towards research and development.

Even the ongoing capital requirements for the Gigafactory have been prudently structured, with 70% of FY26 capex needs already covered by the INR 1,700 Cr term loan which the company is in the process of completing. Besides this, Ola Electric holds INR 3,200 Cr in cash reserves on its balance sheet and has no immediate plans to raise further funds through the QIP or other route.

Ola Electric Curbs Its AmbitionA significant move in this quarter has been Ola Electric’s decision to cap the cell Gigafactory’s scale at 5 GWh, a step down from earlier plans to expand to 6.4 GWh.

“We believe five gigawatt-hours will be sufficient through FY29. This capacity should cover approximately 1.2 Mn vehicles, which we expect to meet our internal needs. Even if we eventually supply to non-Ola customers, this should still be adequate,” Aggarwal claimed in the company’s post earnings call today.

Notably, the original expansion plan was tied to anticipated future demand and structured, in part, around government PLI incentives.

It is pertinent to note that a part of funds raised during the company’s INR 6,145.5 Cr IPO last year, about 20% or INR 1,220 Cr was to be allocated towards expansion of Gigafactory’s scale from 5 GWh to 6.4 GWh.

Nevertheless, the cash now, is to be used in more ‘productive use cases’, according to Aggarwal. He didn’t disclose what exactly though.

Having said that, one assumes this is another push in Ola Electric’s vertical integration strategy. The company is now manufacturing and developing in-house a wide range of critical vehicle components, from motors and motor controllers to wiring harnesses, battery cells and even ABS units now.

Notably, the Indian government has recently mandated that all new two-wheelers have ABS regardless of engine size or type. The company plans to incur less cost by manufacturing these in house as well.

This level of component ownership is highly uncommon in the Indian EV industry, where many companies remain dependent on third-party suppliers.

Earlier in May this year, Ather CBO Ravneet Phokela told Inc42 that it doesn’t make sense for EV companies to manufacture everything in-house, as achieving profitability requires massive scale, something more easily attained through outsourcing.

However, Ola Electric is sticking to its guns. According to Aggarwal, it improves gross margins, allows tighter control over product quality, facilitates software-defined innovations, and insulates Ola Electric from supply chain volatility.

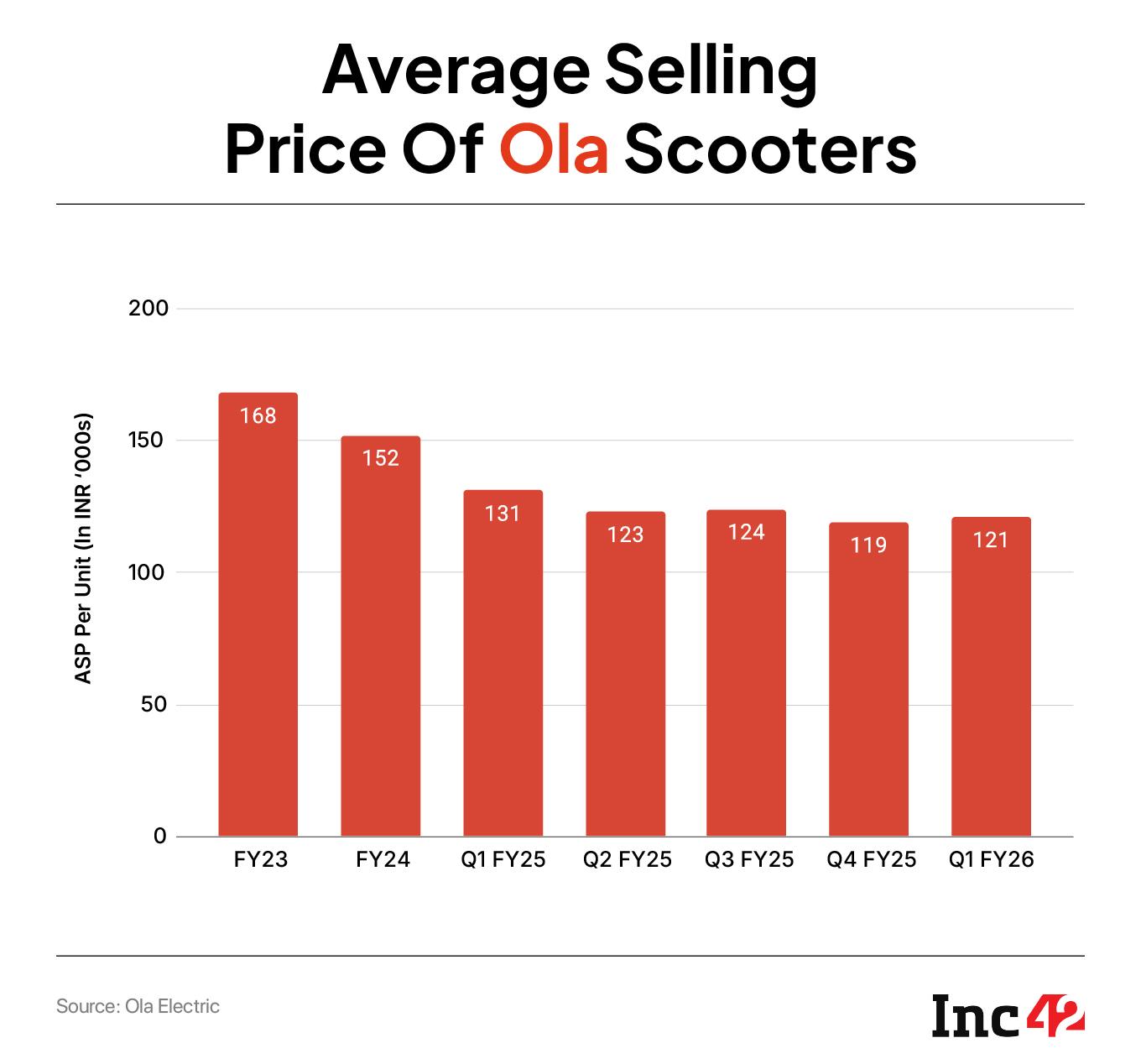

Is Ola Electric In The Clear?While Aggarwal has tried to spin Ola Electric’s slowing revenue as a consequence of the turn towards profitability, it’s hard to say that the company is completely on a clear path in terms of the future.

As we reported in early June, the company’s reputation is still not completely repaired after a year full of controversies and legitimate concerns around vehicle quality. There were also allegations of sales inflation, which have been denied, but what is undeniable is that Ola Electric’s sales momentum has slowed down.

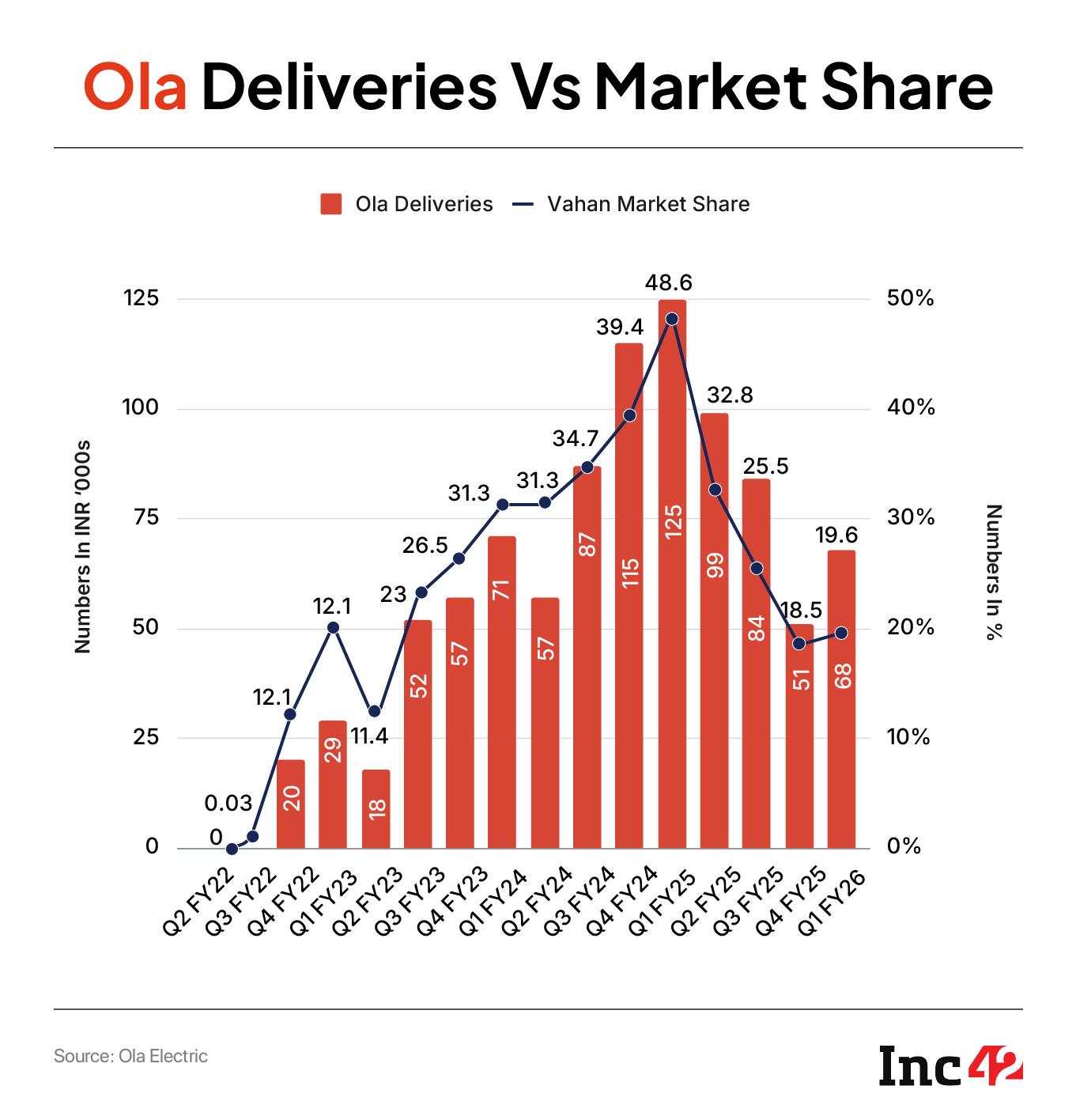

The company delivered 68,192 EVs in the opening quarter of FY26, which is much lower than around 1,25,198 EVs delivered in the same quarter last year.

Saharsh Damani, CEO of the Federation Of Automobile Dealers Associations (FADA), told Inc42 that Ola Electric is up against stiff competition thanks to the rising market share of the likes of TVS Motors, Bajaj, Hero and other OEMs. “Disruption alone doesn’t guarantee sustainability. Culture, governance, and stakeholder trust matter more than hype,” Damani said.

For instance, Ather Energy outpaced Ola Electric in terms of revenue in the previous quarter, and it’s likely to improve its fundamentals in Q1FY26 as per expectations of analysts.

For instance, Mehta Equities’ Prashanth Tapse believes that institutional investors are now looking to take bets on Ather Energy and they might shift their investment strategy in this segment. Even for retail investors that are looking to invest in the two-wheeler EV space, he currently gives more weightage to Ather Energy over Ola Electric, given the former’s superior product quality and better management.

While Aggarwal and Ola Electric have tried to show improvements in the fundamentals, the fact is that despite its bullishness around profitability, the company cannot simply take its foot off the sales accelerator. In the automobile business — particularly, two wheelers — new launches are an essential part of capacity utilisation and profitable growth.

Edited by Nikhil Subramaniam

The post Is Ola Electric Bullishness Justified After Q1’s Higher Losses? appeared first on Inc42 Media.

You may also like

Cristhian Mosquera breaks silence after Arsenal transfer agreement reached

Davina McCall makes stark 'dying' admission after brain tumour hell

Conor McGregor horror as X-rated nude photo leaked by Azealia Banks amid 'threats'

The Couple Next Door's return slammed as 'waste of time and energy' by viewers

Drivers will get taxpayer-funded grants to buy electric cars under £650m scheme