Despite macroeconomic headwinds, investor sentiment remained bullish about the Indian startup ecosystem in the first half (H1) of 2025. According to Inc42’s Indian Tech Startup Funding Report, H1 2025, the world’s third-largest startup ecosystem saw a capital infusion of over $5.7 Bn across 470 deals in H1 2025, marking a modest 8% uptick from $5.3 Bn raised in H1 2024.

Here are some key takeaways from the report:

- Mega deals ($100 and more) surged 57% YoY to 11

- Growth stage funding was up 18% YoY at $2 Bn+

- Early stage startup funding fell 31% YoY to $406 Mn

- Funds worth $6.8 Bn+ were launched in H1 to back Indian startups

- India minted five new unicorns – Netradyne, Drools, Porter, Fireflies AI, and Jumbotail

- M&A activity up 40% to 52 in H1 2025

Bengaluru Retains The Crown: The startup hub continued to lead the charts with $2.5 Bn raised. Delhi NCR followed suit, accounting for $1.5 Bn in funding across 116 deals.

Sectoral Standouts: Fintech continued to be investors’ favourite, with startups in the sector raising $1.6 Bn across 68 deals — a 56% jump from $1.1 Bn raised through 84 deals in H1 2024. However, ecommerce led in deal volume, topping the charts with 109 funding rounds and securing $1.2 Bn in total, a 53% increase from $561 Mn in the same period last year.

What Next? Based on Inc42 estimates, the total startup funding for 2025 is expected to be in the range of $14 Bn to $15 Bn. According to Inc42’s half-yearly investor survey, early and growth stage investors are most bullish on AI startups, which are likely to attract significant capital in H2 2025.

While we will keep a keen eye on the funding trends shaping the world’s third-largest startup ecosystem, here is what shaped the first half of 2025.

From The Editor’s DeskShadowfax Files Confidential DRHP: Three months after turning into a public entity, the logistics major has filed its DRHP with SEBI via the confidential route for an INR 2,500 Cr IPO. Aequs, Groww, Shiprocket, boAt, and PW also filed their DRHP via confidential route this year.

Curefoods’ Flat FY25 Loss: The cloud kitchen major’s net loss remained flat at INR 169.9 Cr in FY25 as against INR 172.6 Cr in the previous fiscal. Operating revenue rose 27.4% YoY to INR 745.8 Cr in FY25. Curefoods reported an attrition rate of 100%+ for the third consecutive year in the fiscal.

Eight Roads Makes $50 Mn In Exits: The VC firm has sold its stakes in MoEngage, Shadowfax and Whatfix in a secondary deal to TR Capital. Managing funds worth $1.6 Bn in India, Eight Roads’ portfolio includes Blissclub, Chai Point and PharmEasy.

Pine Labs Books Profit In 9M FY25: The IPO-bound fintech reported a net profit of INR 26.1 Cr in 9M FY25 as against a loss of INR 151.6 Cr in the same period last fiscal. Meanwhile, operating revenue jumped 23% YoY to INR 1,208.2 Cr in the period under review.

Eeki Nets $7 Mn: The agritech startup has raised the capital in its Series A2 round led by Sixth Sense Ventures. The Kota-based startup leverages IoT-powered growing chambers to grow high-quality, nutrient-rich vegetables and fruits.

Govt Legalises Bike Taxis: The Centre has revised the motor vehicles aggregator guidelines to give legal mandate to bike taxi operations in the country. However, state governments have been empowered to impose fees on aggregators to issue permits for bike taxis.

UPI Takes A Hit In June: The digital payment infrastructure clocked 18.40 transactions in June, down 1.5% from 18.68 Bn in the previous month. The value of transactions also declined 4.4% month-on-month to INR 24.04 Lakh Cr last month.

Zango Nets $4.8 Mn: The regulatory compliance startup raised the capital in a seed round led by Nexus Venture Partners, with participation from existing backers. Zango leverages AI to provide regulatory compliance solutions to banks and financial institutions.

Inc42 Startup Spotlight Can NapTapGo Challenge OYO In India’s Budget Accommodation Space?India’s fast-growing travel and gig economy has created a strong need for affordable, hygienic, and flexible accommodation, especially in cities and transit hubs. Yet, the market still lacks privacy-focussed, high-density lodging at scale. Budget travellers, students, solo professionals and pilgrims often struggle to find clean and convenient options within reach.

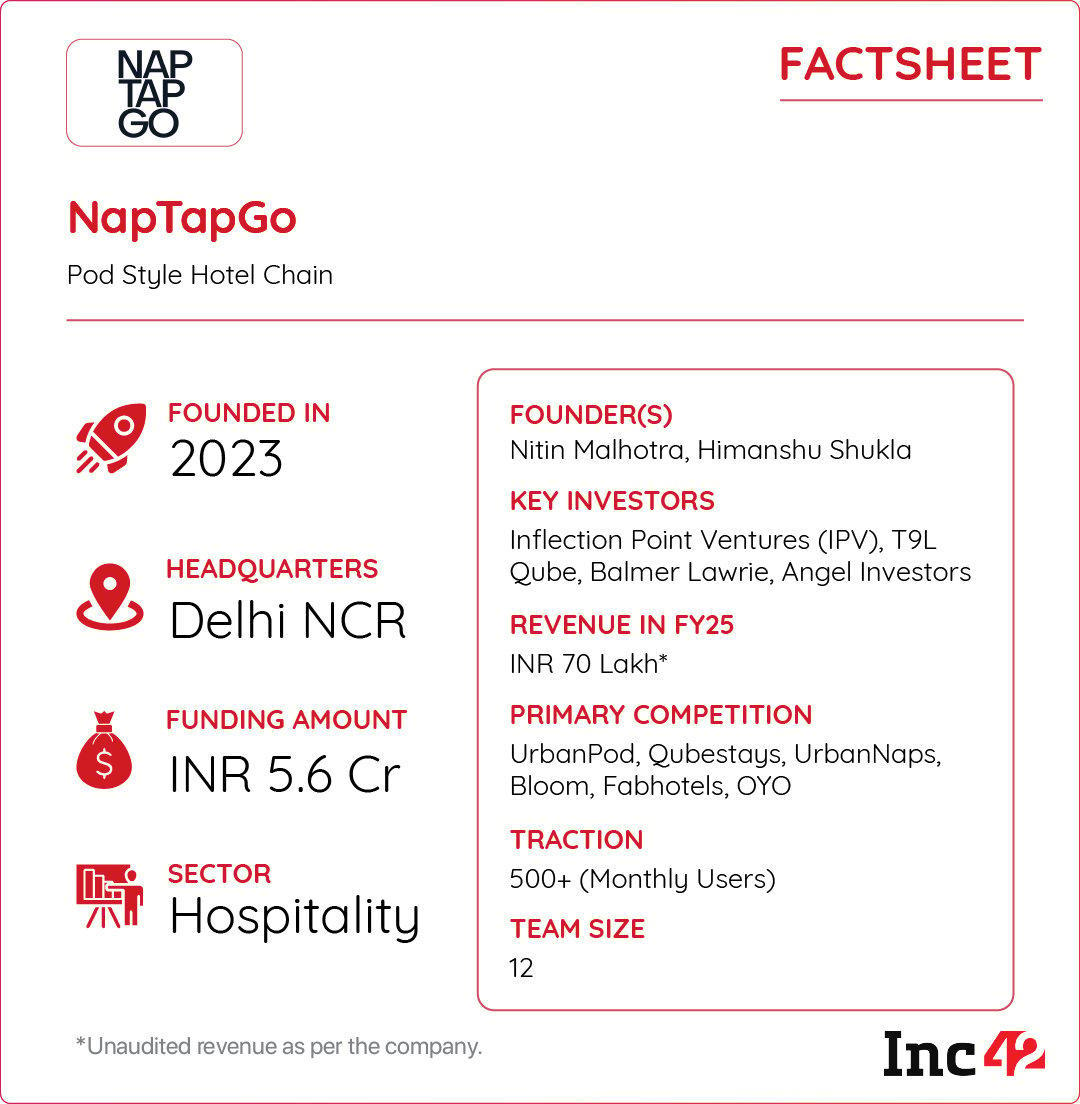

Making The Transit A Cakewalk: Founded in 2023 by Nitin Malhotra and Himanshu Shukla, NapTapGo is introducing capsule hotels to India — inspired by Japan’s pod hotels. Their compact properties, offering 30 beds in just 300 sq m, demonstrate that low-capex, high-repeat pod stays can work in India.

Not Pricey, But Affordable: NapTapGo’s pricing starts at just INR 500, with an emphasis on privacy, hygiene, and ease of booking. Currently operational in Noida and Amritsar, the startup boasts a customer repeat rate of 35% and a revenue of INR 70 Lakhs in FY25. Its average monthly footfall has also jumped from just 10-15 to 500.

Riding The Growth Horse: NapTapGo aims to expand its footprint to 5-8 more cities, including Bengaluru, Mumbai, Katra, Varanasi, and Udaipur, by FY26-end. The bigger vision is to scale to 100 properties across India by FY27 to secure an edge over rivals.

With the ambition to carve out a niche in India’s hospitality sector with a new format built for scale, can NapTapGo win the low-cost hospitality market dominated by OYO?

The post Startup Funding On The Mend, Shadowfax’s IPO Ahead & More appeared first on Inc42 Media.

You may also like

'Anti-national': BJP MPs object to Medha Patkar's presence; storm out of parliamentary panel meet

RBI panel likely to recommend India retains 4% inflation target

Are Tara Sutaria & Veer Pahariya Dating? Actors' Photos From Same Location Spark New Relationship Buzz

Indian stock market opens higher, IT stocks shine

'Send Her A Kiss From Me': Carlos Alcaraz Sends Heart-Touching Reply To Fainting Fan's Daughter After First Round Win At Wimbledon 2025